Our Courses

1) USA Accounts and Taxes - Practical Training Courses

/1%20US%20Individual%20Tax%20Essentials%20Comprehensive%20Training%20for%20Individual%20Taxation.jpg?updatedAt=1735968308515)

Learn the essentials of U.S.A individual taxation with our comprehensive course. From understanding the basics of taxation and the Internal Revenue Code to preparing Form 1040 accurately, gain the skills and confidence to handle tax returns with ease. Start mastering U.S.A taxes today!

/2%20US%20Corporate%20Tax%20Fundamentals%20Comprehensive%20Training%20for%20Business%20Taxation.jpg?updatedAt=1735968305471)

Build a strong foundation in U.S.A corporate taxation with our comprehensive course. Learn key principles, explore tax codes for businesses, and master the preparation of forms like 1120, 1120-S, and 1065. Start confidently handling business tax returns today!

/3%20Mastering%20US%20Taxes%20%20Individual%20&%20Corporate%20Taxes%20Essentials.jpg?updatedAt=1735968304948)

Gain a comprehensive understanding of U.S.A individual and corporate taxes with this in-depth training. Explore key IRC sections, tax laws, and forms like 1040, 1120, and 1065, with practical exercises and compliance strategies. Build confidence in preparing accurate tax returns for individuals and businesses today!

/4%20US%20Accounting%20Basics%20to%20Intermediate%20%20Essential%20Bookkeeping%20Training.jpg?updatedAt=1735968304019)

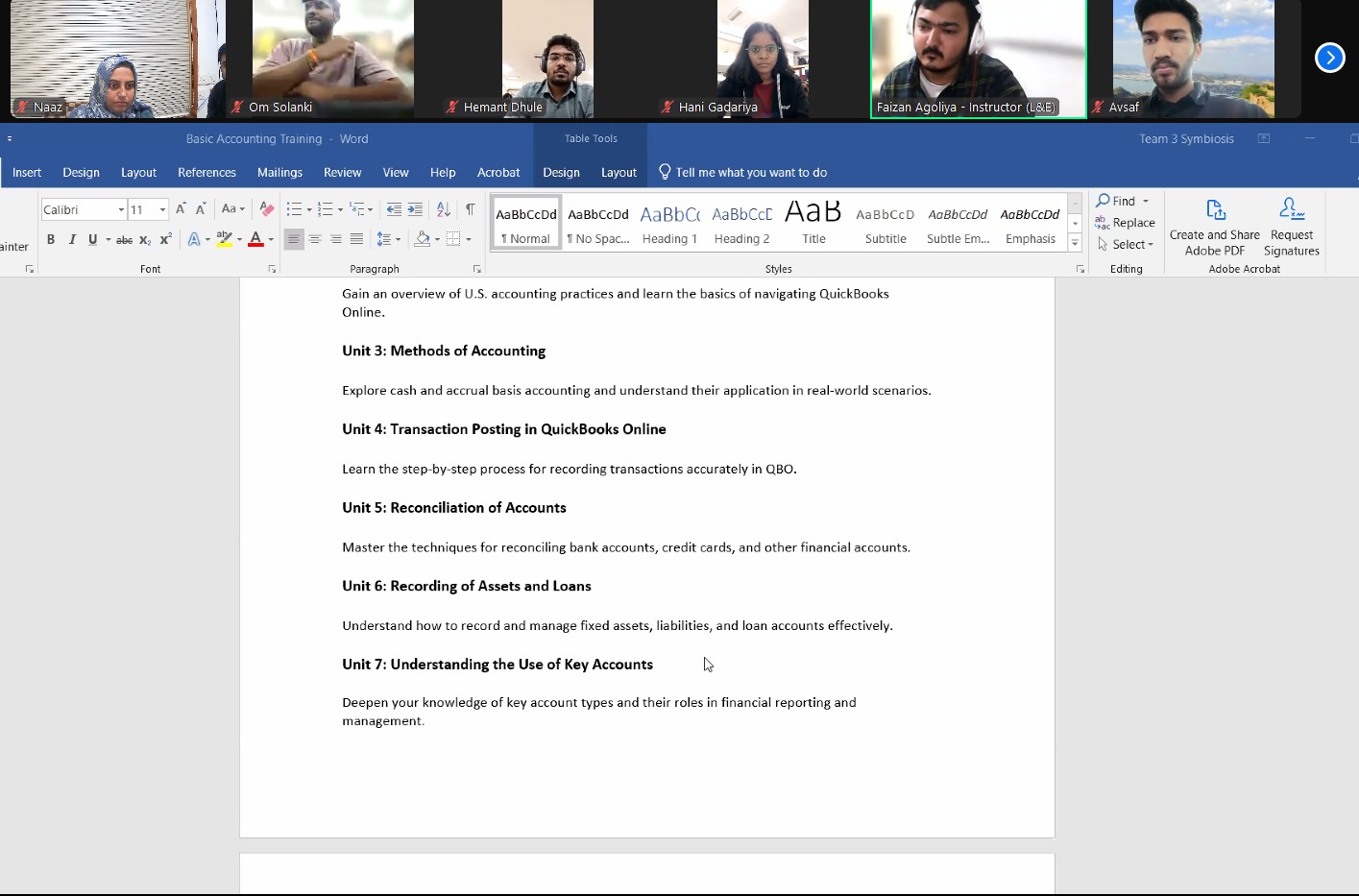

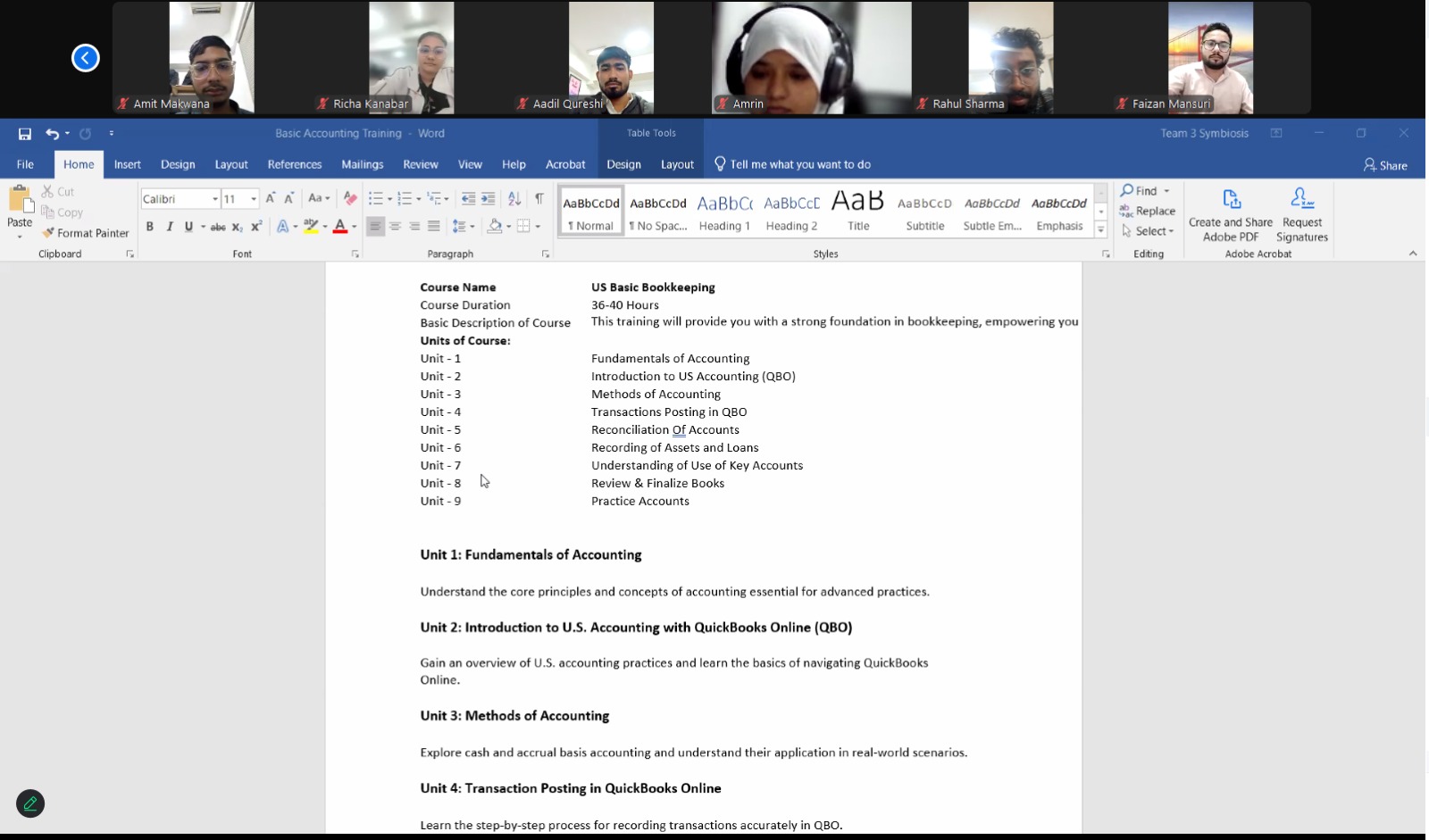

Learn the essentials of U.S.A bookkeeping with this comprehensive course. Master QuickBooks Online and Desktop, handle cash and accrual basis bookkeeping, and confidently manage transactions, reconciliations, and financial tasks for businesses of any size. Start your journey today!

/5%20USA%20Accounting%20Mastery%20Advanced%20Accounting%20Training.jpg?updatedAt=1735968309757)

Advance your accounting expertise with this specialized course in U.S.A business accounting. Learn advanced QuickBooks Online and Desktop techniques, master accounting review processes, and confidently handle complex tasks like payroll reconciliation and book finalization. Enroll today!

/6%20Mastering%20USA%20Accounts%20from%20Basics%20through%20Advanced%20Level.jpg?updatedAt=1735968295593)

Gain comprehensive U.S.A accounting skills with this all-level training course. From mastering accounting basics to advanced tasks like financial analysis and tax preparation, you'll excel in QuickBooks Online and Desktop. Start your journey to accounting expertise today!

/7%20Mastering%20USA%20Taxes%20&%20Accounting%20Individual,%20Corporate%20Taxes%20&%20Bookkeeping%20Essentials.jpg?updatedAt=1735968294143)

Master U.S.A taxes and accounting with this comprehensive course covering bookkeeping essentials, QuickBooks proficiency, and tax compliance for individuals and corporations. Learn to handle bookkeeping tasks and prepare tax forms like 1040, 1120, and 1065 with confidence. Enroll today!

2) USA - IRS Enrolled Agent Certification Courses

Master U.S.A taxes and accounting with this comprehensive course covering bookkeeping essentials, QuickBooks proficiency, and tax compliance for individuals and corporations. Learn to handle bookkeeping tasks and prepare tax forms like 1040, 1120, and 1065 with confidence. Enroll today!

Master the complexities of business taxation with our comprehensive course designed for aspiring Enrolled Agents. This program covers key topics such as business entities, tax law application, and compliance essentials, equipping you with the expertise to excel in the EA Part 2 exam. Start your journey to becoming a tax professional today!

Gain a thorough understanding of IRS representation, ethical practices, and procedural rules with this essential course. Tailored for aspiring Enrolled Agents, this program equips you to handle client representation effectively while preparing for the EA Part 3 exam. Build your expertise and elevate your professional credibility today!

Prepare to excel as an Enrolled Agent with our all-inclusive course covering all three parts of the EA exam: Individual Taxation, Business Taxes, and Representation, Practices, and Procedures. This program offers in-depth knowledge, practical insights, and exam-focused strategies to help you master IRS tax laws and regulations. Take the first step toward becoming a trusted tax expert!

3) Stock Market - Practical Training Courses

This comprehensive training course on the Indian stock market is designed for beginners and intermediate learners who want to understand the fundamentals, techniques, and strategies of investing and trading in the Indian stock market. The course will provide insights into equity, technical analysis, fundamental analysis, and regulatory aspects.